How to Live and Work in France as a Self-Employed Professional

Turn your freelance career into a lasting future in France with the Entrepreneur/Profession Libérale visa

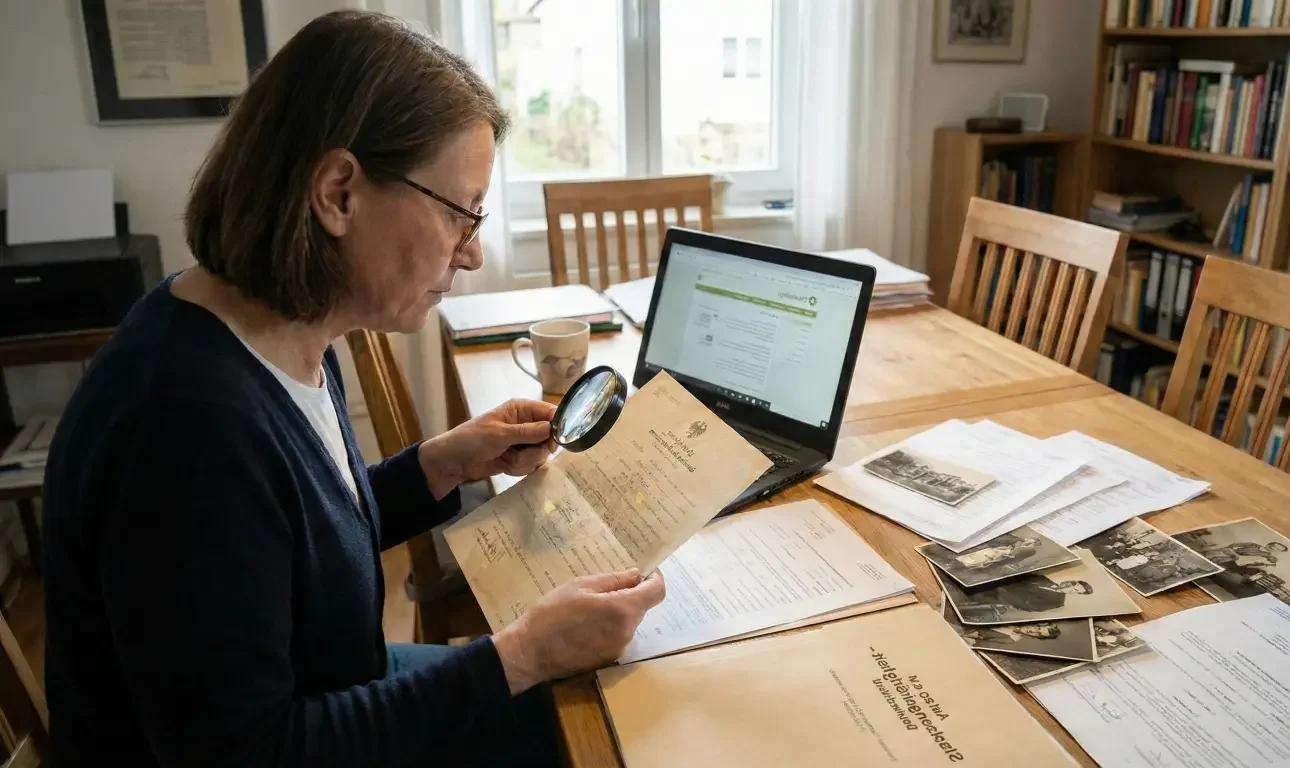

Imagine this: you’ve built a thriving freelance career — you’re consulting, creating, advising, making things happen on your own terms. Now imagine doing that under the golden sun of France — sipping your morning café au lait on a terrasse in Paris, walking the gardens of Provence on your lunch break, launching your own business in the heart of Europe, no French employer required. That might sound dreamy, but for many international professionals, consultants and small-business owners, this is increasingly not only possible but entirely realistic. Welcome to your pathway to a new life: the French Entrepreneur/self-employment visa.

In this article we’ll guide you through the full story of how you can live and work in France as a self-employed professional. We’ll map the benefits, the real requirements, the data behind the decision, and we’ll help you ask the right questions, take real action steps and consider the long-term picture. If you’ve ever dreamed of turning your freelance career into life in France — this is your roadmap.

Why France? Why now?

France is one of the world’s most admired places to live: rich culture, high quality of life, excellent infrastructure, central location in Europe, great food and wine (yes, bonus!). But for professionals and entrepreneurs it offers more than scenery. The French government has recognised the value of attracting international talent and self-employed individuals who can run their own business, bring new ideas, contribute to the economy.

According to information from official French immigration-sites and specialist advisors:

-

The long-stay visa bearing the mention “entrepreneur/profession libérale” allows non-EU nationals to establish self-employment or independent professional activity in France.

-

The multiyear “passport talent” route (e.g., mention “business founder” or “innovative project”) is a further option for founders of a business in France. Migration and Home Affairs+1

-

One specialist site notes that France’s Entrepreneur Visa is designed to attract freelancers and independent professionals who want to live and work in France on their own business terms.

In short: if you run your own business, provide consulting or freelance services, and you’re open to living in Europe, France offers a pathway that aligns with modern professional flexibility.

Meet “Anna”

To make this real, let’s meet Anna. Anna is a marketing consultant based in Mexico City. She has built a solid independent business: she advises Latin-American tech startups, manages remote teams, travels frequently for client workshops, and has a six-figure income in USD. She dreams of a change of scenery: she wants to spend part of the year in Europe, expand her brand in new markets, enjoy better travel access and a European lifestyle.

One morning, over croissants and espresso in a cozy Paris café, Anna imagines her next chapter: she could move to France, set up her own consulting company there, register as self-employed (profession libérale) and live with the freedom of working remotely, while drawing from the advantages of being based in France. She explores the visa route, realizes she meets the income and savings thresholds, secures an apartment, finds health-insurance that covers her stay — and she takes the leap. Within a year, she’s operating as a French-resident independent consultant, earning in euros (and still servicing Latin-American clients), enjoying weekends exploring the French countryside and travelling freely across the Schengen zone.

That story may sound idealized — yes, there are logistics and paperwork — but it shows you what’s possible. If Anna can do it, you can too —with the right planning and the right support.

Key benefits for you (the self-employed professional)

Let’s highlight the major benefits for potential clients (that is: professionals like you, or business-owners, freelancers, independent consultants) who consider moving to France under the self-employment route:

-

No employer required — You are your own boss. Unlike many work-visa schemes tied to an employer, this route allows you to run your own business or provide your services independently.

-

European location & mobility — Based in France, you have access to Europe: travel easily across the Schengen zone, attend European conferences, access European markets.

-

Quality of life — France offers high standards for healthcare, education (if you bring a family), infrastructure, cultural richness. Living abroad becomes the lifestyle change you’ve been seeking.

-

Business opportunity — Operating in France means you can tap into a new business environment, serve French or European clients, build a multinational presence.

-

Path to long-term residence and citizenship — Provided you meet conditions over time, you can shift from the initial visa to multiyear residence and potentially citizenship. For example, the EU-long-term resident status route is available for self-employed permit-holders after certain years.

-

Flexibility and autonomy — For freelancers and independent professionals, this visa aligns well with the flexibility mindset: you set your hours, you design your business, you live where you want.

-

Branding & prestige — Twenty years from now you can say “I’m based in France” — a strong narrative for your personal brand, your clients, your network.

What are the real requirements?

Now let’s move into the actionable part: what you actually need to qualify for the French self-employment / entrepreneur visa. This is where the data, thresholds and steps matter. Below you’ll find the key requirements and how to plan accordingly.

Financial resources and viability

One of the core criteria is demonstrating you either have sufficient financial means (income or savings) or that your business project is viable and will provide sustainable resources. For example:

-

A French government site says that to enter France as a self-employed worker you must “demonstrate the economic viability of your project” and “show that your project provides you with sustainable financial resources at least equivalent to the minimum legal wage in France” (SMIC) for a full-time worker.

-

The minimum legal wage (SMIC) is regularly updated; one site notes that for the “entrepreneur/liberal profession” card the income must be at least €21,621.60 (from Nov 1 2024) in one example.

-

A service-public site states that for a liberal activity you must provide proof of the activity’s capacity to generate income at least equal to €1,801.80 monthly.

Action step: Audit your current freelance income and savings. Do you already earn (or can you forecast earning) at least the French minimum wage equivalent? If yes, that’s a strong starting point. If not, plan to ramp up revenue or accumulate savings to meet the threshold.

Housing and health insurance

Beyond the business side, you’ll need to satisfy practical living conditions in France:

-

You’ll need to show proof of accommodation in France (your French address/rental contract). This proves you have a place to live once in the country.

-

You’ll need travel and health insurance that covers your stay, or enrol in the French healthcare system depending on your status. Some visa categories require you to have health coverage from day one.

-

The business-plan oriented visa still expects the applicant to indicate housing arrangements and the stability of their life in France. (Many advisors list this as a must-have step.)

Action step: Before applying, secure or arrange for French accommodation (even with a minimum lease or reservation) and ensure you have health insurance covering your relocation period.

Business plan or nature of activity

While the simplified “freelancer move to France” storyline sounds straightforward, you’ll need to articulate your business activity and how it meets French requirements. Some of the key considerations:

-

For the “entrepreneur/profession libérale” long-stay visa, your self-employment or independent professional activity must be real, viable and compliant with applicable French law/regulation.

-

If your activity is regulated in France (for example, if you plan to practice as a lawyer, architect or regulated profession), you must meet French qualification or registration requirements. Migration and Home Affairs+1

-

Growing numbers of site-specialists show that you should prepare a detailed business plan (with financial projections, marketing plans, client base, viability) especially if you’ll apply for a multi-year residence permit.

Action step: Draft your business plan: Who are your clients? What services will you deliver from France? What is your income projection for the first 12 months? How will you market and grow? Have you checked whether your profession in France requires special licensing or registration?

Application process & timeline

Let’s summarise the application route so you know what you’re facing.

-

Choose the correct visa path. For simple self-employment, the “visa long séjour valant titre de séjour (VLS-TS) entrepreneur/profession libérale” is common.

-

Apply via the French consulate/embassy in your home country (or apply for a change of status if you’re already residing in France on another permit).

-

Upon arrival in France you may need to register with the French immigration office (OFII) within a defined time period, validate your visa, and convert the visa to a residence permit if necessary.

-

Renewal and long-term status: After the initial visa period (often one year for VLS-TS), you’ll need to apply for extension or a multi-year residence permit (“carte de séjour”) if you plan to stay. For example: renewal evidence includes proof you still meet financial/micro-business requirements. Welcome to France

Action step: Map your timeline: target date for move, prepare documents 2-3 months ahead, account for French consulate processing times (which may be 1-3 months). Factor in arrival, OFII registration, lease/housing set-up, business registration in France.

Legal registration of your business activity

As part of activating your self-employment in France, you’ll typically register your business or professional activity with the relevant entity. For example:

-

As a freelancer or consultant you might register as an auto-entrepreneur (“micro-entreprise”) or as a “profession libérale” under French tax/regulatory codes.

-

According to service-public.fr, if you create a liberal activity you must provide proof of registration (URSSAF, etc) and proof the activity will generate the required monthly income.

Action step: Choose your French business structure (micro-entreprise, EURL, SASU, etc), check with a French accountant/legal advisor. Register with URSSAF (for social security contributions) and comply with French tax obligations.

Mapping the expenses and living costs

Understanding the costs of relocation and the baseline living and business costs is essential to make a sound decision.

Business start-up / relocation costs

-

Visa application + residence permit renewal: For example the “entrepreneur/self-employed card” has a tax of about €200 + stamp duty €25. France-Visas+1

-

Business registration costs, accounting/consulting fees (especially for non-French speakers), translation of documents, legal advice.

-

Accommodation deposit, utilities setup, French bank account, health insurance premium until coverage begins, possible language lessons.

-

Marketing or website adaptation for French/European clients, potential travel.

Living costs in France

-

Housing in major cities like Paris can be expensive. But you may choose smaller cities or provincial towns for lower cost of living while still enjoying the French lifestyle.

-

Daily living: food, transport, leisure, socializing, health insurance. The French standard of living can be higher than many places — so budgeting realistically is key.

-

Tax compliance: as a business owner you must account for French income tax, social contributions (which as a self-employed person may include URSSAF, CFE, etc).

Revenue requirement

You should aim not only to meet the legal minimum income threshold but to build a margin: grow your business, reinvest, save, and treat the relocation as a strategic business move. Consider your target gross revenue for Year 1: cost of living + business overhead + buffer + savings. Then compare it to your projected income.

Strategic tips for success

Here are actionable tips to boost your chances of success and make your transition smooth:

-

Start early with planning – Don’t leave visa application and business plan to the last minute. Give yourself 3-6 months of lead time.

-

Build a French-friendly business narrative – Show how your service or expertise fills a gap in the French or European market, or how you’ll service international clients from France. This strengthens the application.

-

Secure accommodation ahead – Even a rental agreement with an early start date helps. It strengthens your ties to France.

-

Speak to a bilingual accountant/legal advisor – Two languages (your native + French) and two systems (your current business + French business/tax system) means you’ll benefit from local guidance.

-

Keep your current business lean and mobile – Since you’ll be relocating, ensure your business model supports remote work, cross-border clients, minimal fixed overhead.

-

Build your client base before you move – If possible, land 1-2 European or French clients ahead of your move to show momentum.

-

Budget for the first year realistically – Include a cushion of 10-20 % extra for unexpected costs (language lessons, integration, registration effects).

-

Plan exit and growth strategies – After year one, how will you renew the permit? What will Year 2 look like? What if you want to apply for citizenship eventually? Having this ahead of time matters.

-

Language and culture – While you don’t need to be fluent in French at day one, showing a willingness to integrate (language study, networking locally) strengthens your relocation experience and may help long-term residence applications.

-

Family considerations – If you plan to bring spouse/children, check housing size, schooling (international schools vs French schools), health coverage, visas for dependents.

Common pitfalls and how to avoid them

Recognizing what goes wrong helps you preemptively guard your plan.

-

Under-estimating income requirement – Some applicants assume a low threshold; in reality you must demonstrate sustainable income at least equal to France’s minimum wage or more. If you cannot show that, renewal risks rise.

-

Inadequate business plan / documentation – Skipping the details on your services, clients, viability will weaken your visa application.

-

Delaying accommodation or visa validation – Arriving in France without housing or failing to validate your VLS-TS with OFII in time may cause administrative complications.

-

Ignoring tax/social security implications – French business and tax rules differ from many countries; if you don’t adapt, you may end up with surprise costs or regulatory issues.

-

Overlooking cultural/integration factors – While the visa is about business, living abroad means integration: language, local regulations, forming social networks. Underestimating this affects your overall experience.

-

Failing to plan renewal or long-term steps – The first visa is just Year One. If you don’t meet renewal criteria (income, business viability) you may face shorter permits or return to your home country.

-

Not consulting professionals – Especially if your business is complex or if you have dependents, using a French immigration advisor/attorney makes a big difference.

What the path looks like: Step by step

Here’s a structured timeline of how your journey could unfold.

Pre-departure (Months –3 to 0)

-

Audit your current business: income, clients, business model.

-

Research cost of living in your target French city.

-

Prepare your business plan (services, clients, revenue projections, marketing strategy).

-

Begin French pronunciation/ language basics (optional but helpful).

-

Secure preliminary housing or browse rentals in France.

-

Choose your visa path and gather required documentation (passport, CV, business portfolio, savings/income statements, insurance quote).

-

Engage with a French accountant/immigration advisor for registration path.

-

Apply for the French long-stay visa (VLS-TS) entrepreneur/profession libérale or equivalent.

Arrival and Year One (Months 1-12)

-

Enter France on your long-stay visa. Validate your VLS-TS with the French Office for Immigration and Integration (OFII) where required.

-

Register your business activity (URSSAF, local prefecture) and set up your accounting system.

-

Move into your housing, open a French bank account, subscribe to health insurance.

-

Launch your business in France: marketing, networking locally, servicing clients, maintaining your current clients remotely.

-

Monitor your income against the minimum threshold. Keep all financial records.

-

Engage in French-local social or networking activities to build presence.

-

At around month 11, check renewal requirements and prepare your file for the residence permit renewal.

Renewal / Year Two and beyond

-

If your first year is successful, apply for the 2nd-year residence permit (carte de séjour) for the “entrepreneur/profession libérale” mention.

-

Evaluate whether you want to apply for the “passport talent – business founder” or aim for long-term EU resident status after 5 years.

-

Expand your business: hire a subcontractor, extend services to French clients, ramp up revenue.

-

Revisit your tax strategy and consider how to optimize for French corporate/individual tax.

-

Explore family reunification (if applicable), schooling for children, integration into French society.

-

After 4-5 years of continuous residence, check eligibility for permanent residence or citizenship.

Real-life numbers and data you should know

Let’s anchor your plan in some real figures.

-

The minimum legal wage (SMIC) in France for full-time work was indicated in certain resources as approx. €21,621.60 as of November 1 2024 for renewal of the entrepreneur/self-employed residence permit.

-

Another French service-public site set the threshold for monthly income proof at €1,801.80 for liberal activity.

-

The administrative cost/taxes for the self-employed card: tax of €200 + stamp duty €25 = €225 total.

-

The “Entrepreneur Visa” specialist site states that to apply, a business plan with viability and demonstration of minimum resources is required.

Who stands to benefit most?

Let’s segment potential profiles and highlight who this route is especially good for:

-

Experienced freelancers/consultants who already have a stable income and clients, and who want to relocate to Europe or re-base their service offering.

-

Independent professionals offering digital services (marketing, design, software, consulting) who can serve global clients and need flexibility and mobility.

-

Small business owners who are ready to expand internationally, want a base in the EU, and can show business viability.

-

Digital nomads or remote-work oriented professionals who prefer to base themselves in a high-quality European destination rather than staying in their home country or a lower-cost digital-nomad hub (though you must still meet the self-employment threshold).

-

Entrepreneurs with a vision of European expansion — launching a start-up from France, servicing clients in Europe, or leveraging France’s location.

When this route might not be the best fit

It’s also worth considering when this might not be ideal, so you avoid misalignment:

-

If your income is unstable or far below France’s minimum threshold and you don’t foresee ramping up quickly.

-

If your business is tied to a single employer/client in your home country and you cannot operate independently.

-

If you are seeking a straightforward passive investment property route rather than active self-employment (because France’s real-estate investment alone does not guarantee this visa). Total Law+1

-

If you aren’t ready for the cost of living or administrative overhead of relocating to France (taxes, housing, business registration).

-

If you are looking primarily for a travel lifestyle without anchoring a business, since the visa expects meaningful self-employment activity, not only leisure.

How this fits into your global mobility strategy

Given your role as B2B Director of 3A Immigration Services and your broader global mobility services mission, let’s highlight how you can position this visa route for your clients and marketing.

-

For independent professionals / digital consultants who already earn abroad, relocating to France becomes a compelling offering: “Live in France, run your own business, tap Europe.”

-

For investor-professionals looking at Europe as a base, emphasizing the self-employment route (rather than only passive investment) adds real business substance.

-

For high-net-worth individuals (HNWIs) the story goes beyond simple relocation: it’s about establishing a continental base, brand building, access to European clients.

-

For global mobility services: you can show clients that you not only help with US visa programs (TN, H2B, etc) but also with European self-employment visas — this broadens your value proposition.

-

Marketing angle: Use storytelling (like “Anna”) to make it relatable. Use data (income thresholds, cost estimates) to make it credible. Use actionable steps (checklist) to make it tangible.

-

Lead generation: You could create a landing page or downloadable checklist “Checklist: Move to France as a Freelancer” and promote via LinkedIn to independent professionals seeking European relocation.

Actionable checklist for you and your clients

Here is a checklist you or your clients can follow to make this happen:

-

Confirm current freelance income and savings meet/exceed French minimum (approx. €21,000+ gross annually).

-

Draft a 12-month revenue projection post-move (including new French/European clients).

-

Choose target French city (Paris? Lyon? Bordeaux? Smaller town?) and perform cost-of-living research: housing, utilities, transport, leisure.

-

Secure or reserve French accommodation (rental contract or agreement).

-

Choose and engage a bilingual French accountant/immigration advisor.

-

Prepare your visa application: valid passport, completed forms, business plan, proof of accommodation, health insurance, income/savings evidence.

-

Register your business in France (URSSAF, relevant business status) within first months of arrival.

-

Validate your visa in France (OFII registration if required) and attend any required medical or administrative steps.

-

Launch your marketing efforts targeting French/European clients (website localisation, networking, LinkedIn outreach).

-

Monitor your income during the first year and maintain documentation (invoices, bank statements, tax filings) ready for permit renewal.

-

At around month 10-11 plan your first renewal application, gather evidence of continued viability and compliance.

-

Evaluate long-term goals: 4-year permit, 5-year residency, citizenship. Begin language integration and local network building.

The narrative benefit: More than a visa

Relocating to France under the self-employment route is more than flipping a work permit. It’s a narrative shift — from being a remote freelancer somewhere in the world to being a self-employed professional with a base in one of Europe’s premier cultural and business hubs. It allows you to:

-

Rebrand yourself: “French-based consultant/entrepreneur” — which can open doors with clients who value European location.

-

Balance life and work: Enjoy France’s quality of life, travel, culture, food and leisure — while sustaining your business.

-

Expand your network: Being in Europe gives you access to in-person events, co-working spaces, meet-ups you may not have in your current location.

-

Build for the long term: This isn’t just one year of relocation — it can lead to a long-term residence and maybe citizenship — giving you and perhaps your family options for the future.

Addressing FAQs

Q: Do I need a French employer?

No — the route we’re discussing is for self-employed professionals or independent freelancers. You don’t need a French employer sponsor.

Q: How long is the visa valid?

For the “entrepreneur/profession libérale” visa the initial stay is often one year (VLS-TS) then you can apply for renewal and a multi-year residence permit.

Q: What if I bring my family?

Dependents (spouse, children) may join you via family-reunification processes. Check local prefecture rules. Some visa paths allow dependent work rights.

Q: Is the business restricted to certain activities?

Your activity can be self-employment or independent consulting; if you choose a regulated profession you must meet additional French qualification/registration requirements.

Q: Can I switch to citizenship later?

Yes — after years of continuous residence, integration into French society, meeting language and other criteria you may apply for long-term residence or citizenship. For example, EU-long-term resident status after 5 years is possible.

At 3A Immigration Services our global mobility team specializes in helping independent professionals, consultants and entrepreneurs worldwide to build their future in France. Whether you are ready to relocate now or just exploring your options, we can assist with the full process – from business-plan development to visa application, housing, registration and integration. Reach out today for a personalized consultation and let us help turn your dream of living and working in France into reality.

Transitioning your freelance or consulting career into a French adventure is not merely a lifestyle choice — it’s a strategic business move. The self-employment visa routes in France offer you the autonomy to run your own business, access to Europe, high quality of life, and a narrative of global professional mobility that clients and collaborators will notice. But the journey demands planning, financial discipline, and execution. You’ll need to demonstrate viable income, secure housing, register your business, apply for the correct visa and manage your renewal. For those who approach it with preparation, clarity and ambition, France can become more than a destination — it becomes your new professional home base, your springboard to Europe and beyond.

If you’re serious about shifting your base to France, embracing the self-employment lifestyle and growing your business internationally, now is the time to act. Plan ahead, map your income, get the right advisors, and you could be consulting from your favorite French café sooner than you think.